How does Churchteams handle the records of a deceased person?

Automated database actions will handle the records of a deceased person, according to your setting preferences.

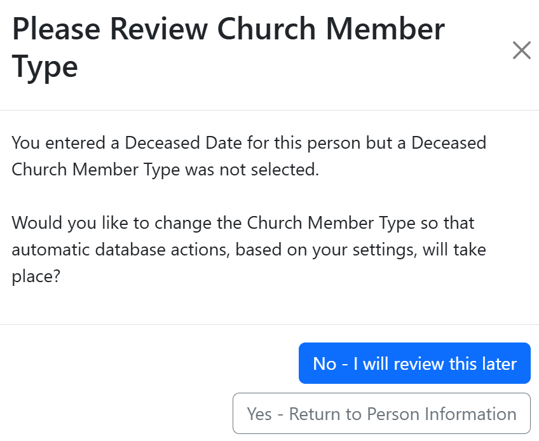

Automated actions for handling deceased people records will only take place upon a change to the Church Member Type. Once a Church Member Type is changed to Deceased, automated actions based on your Settings will take place.

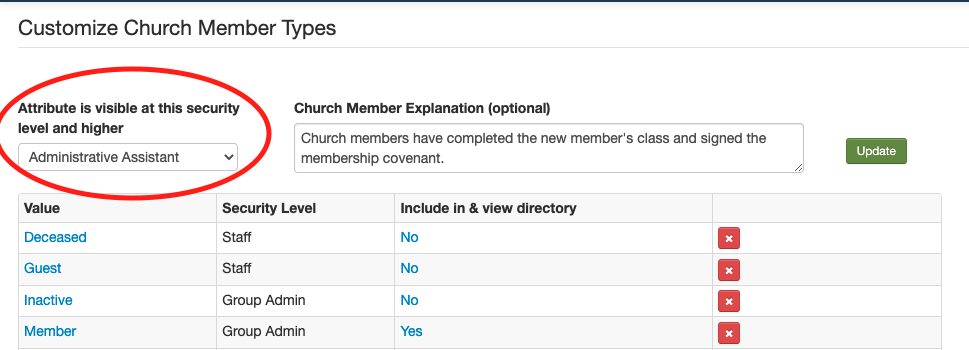

To add "Deceased" as a Church Member Type, go to People > Settings > Church Member Type.

Automated actions created by changing Church Member Type

First, set up your preferences for how Churchteams will handle records marked as Deceased. Go to People > Settings > Deceased Actions. Any actions selected from this settings page will automate based on a change to the Church Member Type to Deceased.

- Remove the email address from the person's record so that mass and group emails will no longer be sent to that email address.

- Remove the mobile (and work phone if applicable) phone number(s) from the record so that outgoing communications will not accidentally go out to those numbers.

- Move the deceased individual out of the household (if previously in a multi-member household) so that mailing labels and directories will not show the deceased person.

- Automatically update information in the "Related To" section of the people profile page for surviving spouse, parents, and/or children. *This information will only update if relationships already exist in the Related To section.

- Set the marital status to Widowed for married adults. *The marital status will only update for married adults if the marital status was already set to "married" and "widowed" is an option in the Marital Status attribute.

- Remove the deceased person from the Groups they were in to accurately show attendance percentages for groups and prevent email or text communications from the group (if the email and phone are left in the record)

- Remove the deceased person from Workflows to prevent any email or text communication (if the email and phone are left in the record).

When someone in your database passes, you can start the selected automated actions by going to that person's information page and changing the Church Member Type to Deceased. This will trigger the automation you set up.

A pop-up message will allow you to review and Continue with the automated actions.

Upon the completion of the automated steps, an email of the updated people attributes will be sent to the email address in the Notification area of the Deceased Actions page. (People > Settings > Deceased Actions)

A System Note of the changes is also logged on the deceased person's personal profile.

Adding a Deceased Date to the Person's record

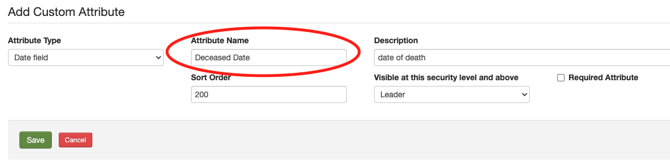

If you do not already, we recommend that you have a custom people attribute to track the date of death for a deceased individual. To add this, log in at the Admin level, go to People > Settings > People Attributes. Click the "New Attribute" button and make selections for the new attribute.

Because the software will prompt you with alerts according to this attribute, it is important that you name this new custom people attribute "Deceased Date."

Please note that once the Church Member Type has been changed to Deceased, we will no longer calculate the age based on the Birth Date attribute.

Handling Contribution Statements for a Deceased Person

While moving a deceased person's record out of the household and removing the email address will help to eliminate accidental mass communication issues, you will want to be sure that a contribution statement is not missed. We recommend that you inquire with the family as to how they would like the statement, based on these options.

1) At the time of adding a deceased date and changing the Church Member Type, you can go ahead and print the Contribution Statement for the person.

2) You can move the Contributions over to the surviving spouse and run the statement as you normally would the following January.

3) You can run a separate batch of printed statements filtered to Deceased Church Member Types to be mailed when you run regular statements in January. *Please note that with this option, the surviving spouse may have had Contributions during the year as well and receive a separate statement either by mail or email. To avoid this, you can temporarily add the surviving spouse's email to the deceased spouse's record and have them both emailed the same day.