How do we apply non-tax-deductible donations toward completing a pledge?

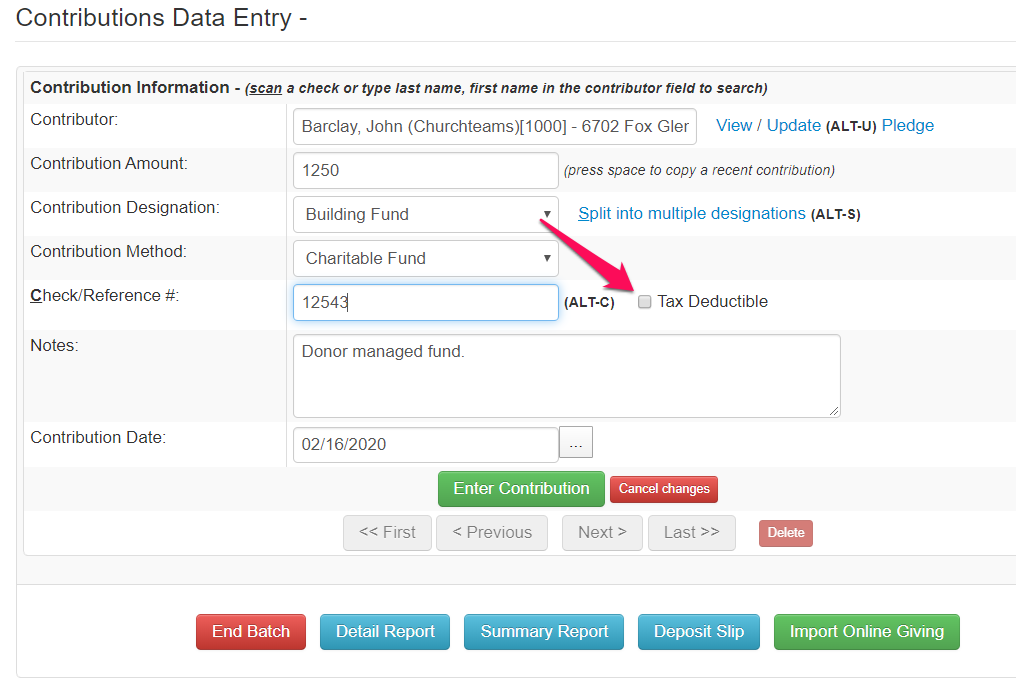

Uncheck the tax deductible option on the data entry screen. It overrides the fund tax status.

Occasionally people want to give something like Stock, Donor managed funds, or even non-cash items to the church and count it toward a pledge.

When you are entering this transaction into a batch, go ahead and enter the donation into the normal fund they have pledged toward. Then un-check the tax-deductible option/flag for that entry. The tax deductible flag/option on the individual donation entry form will override the fact that the default for that fund is Tax Deductible. Then use the Notes fields to provide any necessary details. This handles the tax status nicely and still count towards the pledge. Here is an example.