How to show contributions for a business on statements.

Sole proprietorships are associated with the owner. Corporations are set up as a separate entity.

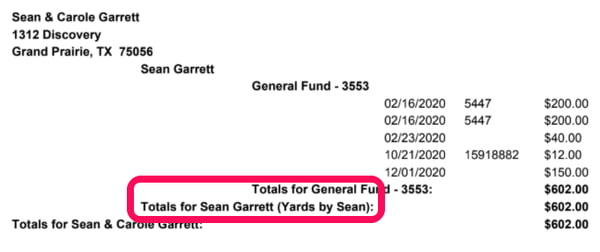

Taxes for sole proprietorship businesses are handled as part of the owner's personal taxes. So, track those either directly on the member's profile or add an optional business name into the profile and continue to add the donation under the person. If you include the optional business name on the member profile, it will show in parentheses to the right of the owner's name in the Totals section on the statement.

Business name on member profile:

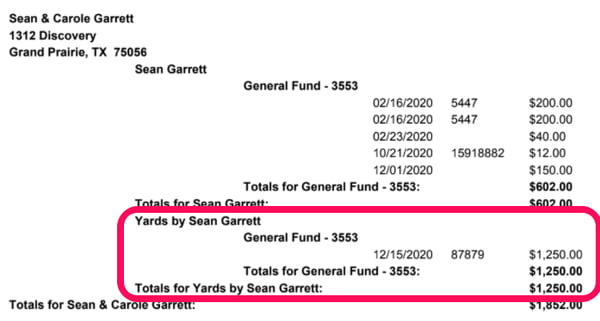

Business name as a family member (separate member profile within the same household):

Business name as a family member (separate member profile within the same household):

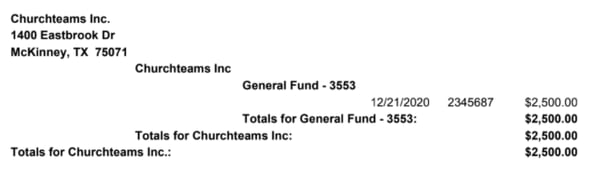

Corporations of any type are separate entities from their owners, and donations should be tracked and managed as a separate person/member in the database (not within the same household, so that personal and business contributions are completely separate). To distinguish these in the database, many churches put the business name as the first name and Inc. or LLC as the last name. That way, all corporations can be easily searched using the last name field.